revolving open end credit example

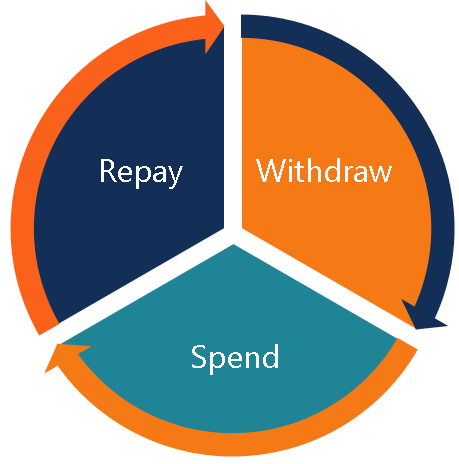

Examples of open-ended credit include the following. With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next.

Revolving Credit Personal Credit Loans Lines Of Credit

With open-end loans like credit cards once the borrower has started to pay back the balance they can choose to take out the funds againmeaning it is a.

. With a home equity line of credit or HELOC a home owner can get a line of credit from the bank backed by the home or real estate property given as collateral were the owner can use the amount of credit needed to perform purchases. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. Common examples of open-end credit are credit cards and lines of credit.

As you repay what youve borrowed you can draw from the credit line again and again. Credit cards and credit lines are examples of revolving credit. Advantages of Open Credit.

Weve already touched on a couple of examples of revolving credit above which could include accounts such as the following. Installment and open credit. Find a Card With Features You Want.

Lets understand with an example. Open-end loans are also sometimes referred to as revolving credit. Credit Cards The majority of credit cards offer a revolving credit line.

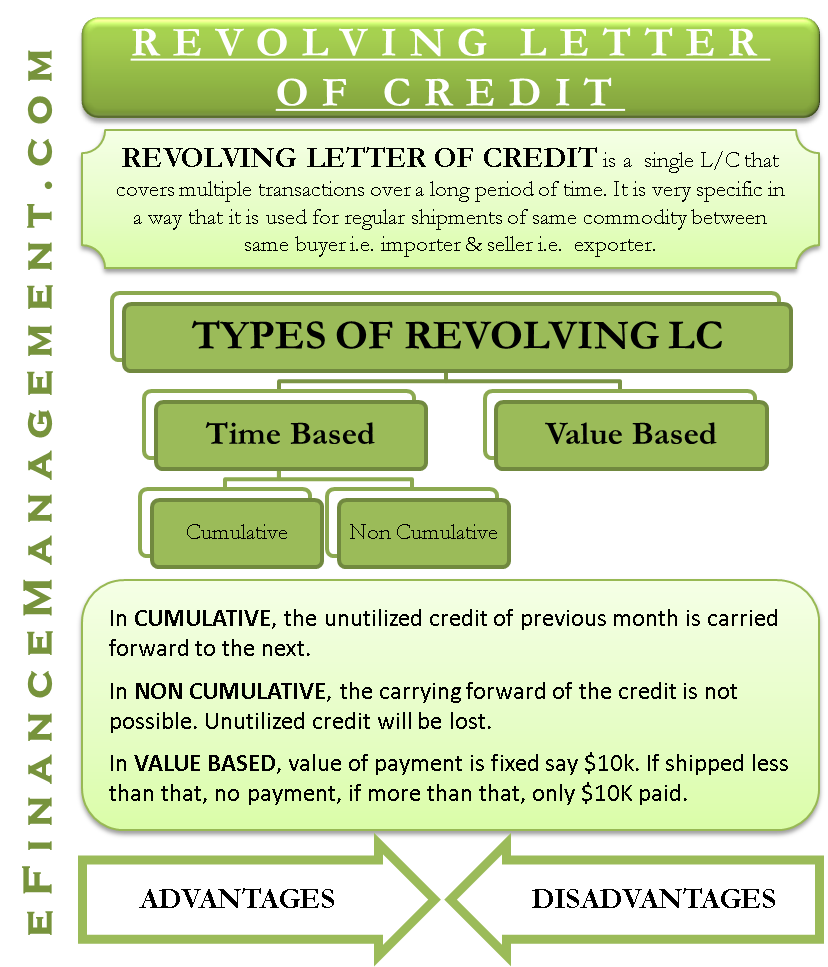

An example of revolving credit is the home equity line of credit. Revolving Letter of Credit Based on Time. Suppliers frequently extend short-term credit to encourage sales to retailers.

Find a Card Offer Now. The three most common examples of revolving lines of credit are credit cards personal lines of credit and home equity lines of credit. As low as 475 variable APR after 12 months.

Once a borrower pays off the 30000 owed the line of credit remains open for re-borrowing later making the line of credit revolving in nature. Three types of revolving credit accounts you might recognize. T he three main types of credit are revolving credit.

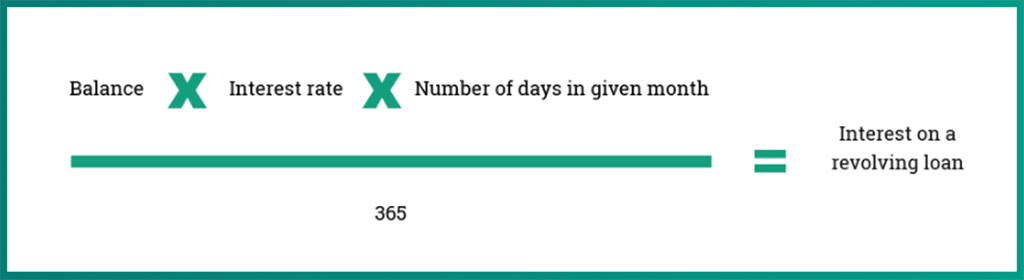

When you carry a balance on a revolving account youll likely have to pay interest. With some forms of open-end credit theres no end date. In contrast to more traditional loans which are given.

When you carry a balance on a revolving account youll likely have to pay interest. Ad See if Youre Pre-Approved. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of.

Three types of revolving credit accounts you might recognize. An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid. Will who is based in the UK.

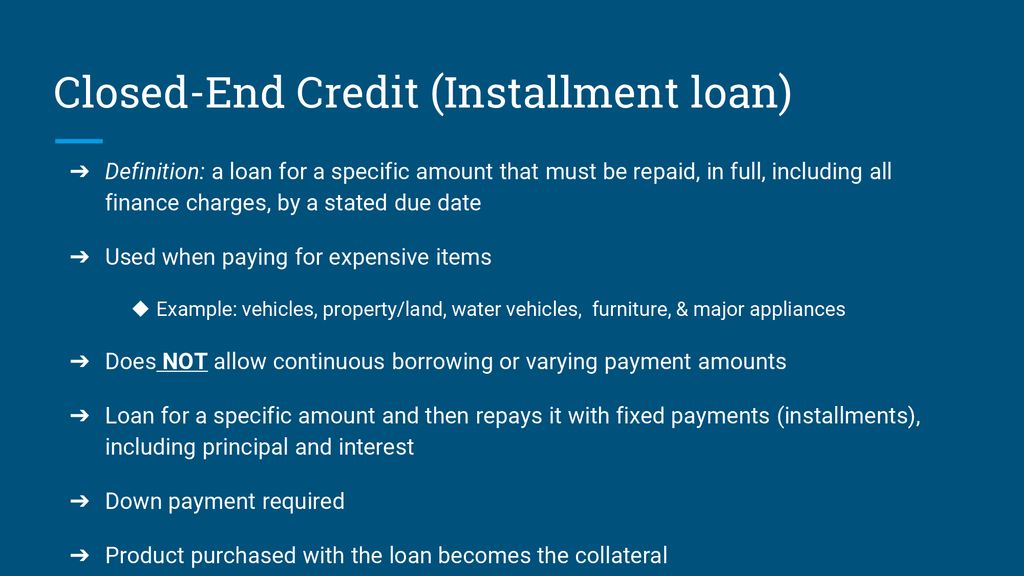

Examples of installment loans include mortgages auto loans student loans and personal loans. This allows borrowers to access as much or as little funds as they chose depending on their current needs. The borrower is able to withdraw indefinitely until the limit is met.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. Personal lines of credit.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. Cho from China is a manufacturer of ball pens and is a regular supplier to Mr. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

For example you may borrow 20000 for 60 months to buy a car. There are three common examples of revolving lines of credit. Trade Credit A trade credit is an agreement or.

Responsible Card Use May Help You Build Up Fair or Average Credit. A credit line that you use at a supplier. In the revolving letter of credit that is based on time a specific amount payment is allowed to be drawn within a defined period of time.

Ad 249 intro APR for the first 12 months. Bank line of credit Revolving credit facility Credit card Home equity line of credit. Instead it permits them to use the money frequently and make timely payments before the limit is reached.

One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed. Personal lines of credit. Examples A credit card with revolving credit.

Open-end credit is a pre-approved loan granted by a financial institution to a borrower that can be used repeatedly. What are the Types of Credit. Home equity lines of credit HELOCs.

It comes with an established maximum amount and the. With a HELOC the borrower receives a loan in the amount of the equity on her house and puts up. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

Revolving Credit Facility A revolving credit facility is a line of credit that is arranged between a bank and a business. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. You may still owe on one purchase while you are purchasing yet another shipment.

With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

Revolving Credit Vs Installment Credit What S The Difference

What Are Three Types Of Consumer Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understanding Different Types Of Credit Nextadvisor With Time

How Revolving Credit Works Howstuffworks

Types Of Credit Definitions Examples Questions

Revolving Credit Vs Line Of Credit What S The Difference

Understanding Different Types Of Credit Nextadvisor With Time

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

What Is Open End Credit Experian

Calculate Payments For A Revolving Line Of Credit Lendio

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Revolving Letter Of Credit Meaning Types With Example

What Is A Credit Utilization Rate Experian

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference